All about Paul B Insurance Medicare Agent Huntington

A lot of people pay the full FICA tax so the QCs they make can be made use of to fulfill the demands for both month-to-month Social Safety benefits and premium-free Part A. Certain Federal, State, as well as regional government workers pay only the Part A section of the FICA tax. The QCs they gain can be used just to fulfill the needs for premium-free Part A; they might not be made use of to satisfy the requirements for month-to-month Social Safety and security benefits.

Paul B Insurance Medicare Part D Huntington - An Overview

A person who is receiving monthly Social Safety and security or RRB advantages, at the very least 4 months before turning age 65, does not require to submit a different application to end up being qualified to premium-free Component A. In this instance, the individual will certainly obtain Component An immediately at age 65. A person who is not obtaining month-to-month Social Safety and security or RRB advantages have to file an application for Medicare by speaking to the Social Security Administration.

If the application is filed greater than 6 months after turning age 65, Component A coverage will be retroactive for 6 months. For an individual whose 65th birthday celebration is on the first day of the month, Component An insurance coverage starts on the initial day of the month preceding their birth month.

People that need to pay a costs for Part A do not automatically get Medicare when they turn 65. They have to: Submit an application to enroll by calling the Social Protection Management; Enroll during a legitimate enrollment duration; as well as Also register in or already have Component B. To keep premium Part A, the person has to proceed to pay all regular monthly premiums and also stay signed up in Component B.

Premium Part A component begins protection starts following the complying with of enrollment.

There is no waiting period. SSA rules do not allow for child handicap advantages to begin earlier than age 18. For internet that reason, Component An entitlement based on child special needs advantage entitlement can never start before the month the individual acquires age 20 (or age 18 if the person's disability is ALS).

How Paul B Insurance Insurance Agent For Medicare Huntington can Save You Time, Stress, and Money.

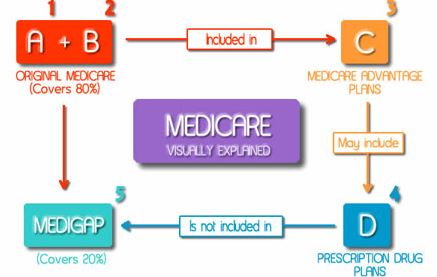

The 3rd month after the month in which a normal course of dialysis starts; or The first month a normal program of dialysis starts if the private takes part in self-dialysis training; or The month of kidney transplant; or 2 months before the month of transplant if the person was hospitalized during those months to prepare for the transplant Individuals already obtaining Social Safety or RRB advantages a minimum of 4 months prior to being qualified for Medicare and also staying in the United States (except locals of Puerto Rico) are immediately signed up in both premium-free Part An and also Component B.

People staying in Puerto Rico that are eligible for automatic registration are just enlisted in premium-free Part A; they should proactively enlist partly B to get this coverage. People who are not obtaining a Social Safety and security or RRB benefit are not instantly enrolled. Individuals who formerly refused Part B, or that ended their Part B registration, may sign up (or re-enroll) partially B Visit This Link just during particular enrollment durations.

Component B is a volunteer program that calls for the repayment of a regular monthly premium for all parts of insurance coverage. Qualification rules for Part B depend on whether an individual is eligible for premium-free Part A or whether the individual needs to pay a premium for Part A coverage. People that are eligible for premium-free Component A are additionally eligible for register in Part B once they are entitled to Component A.

Paul B Insurance Medicare Supplement Agent Huntington for Dummies